[ad_1]

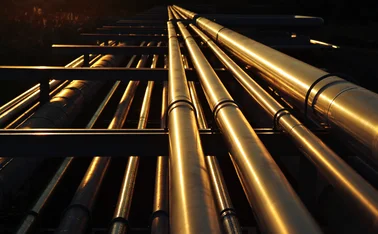

Crude oil futures traded larger on Friday morning because the US introduced plans to replenish its strategic petroleum reserves.

At 9.53 am on Friday, December Brent oil futures had been at $93.25, up by 0.94 per cent; and December crude oil futures on WTI (West Texas Intermediate) had been at $89.31, up by 1.06 per cent.

November crude oil futures had been buying and selling at ₹7435 on Multi Commodity Change (MCX) within the preliminary buying and selling hour of Friday morning towards the earlier shut of ₹7330, up by 1.43 per cent; and December futures had been buying and selling at ₹7335 as towards the earlier shut of ₹7246, up by 1.23 per cent.

The US Division of Vitality has indicated that it’s going to purchase 6 million barrels of crude oil that needs to be delivered between December and January. Market studies stated the US Division of Vitality will signal buy contracts for the refill at $79 a barrel or much less.

The US had drawn round 200 million barrels from its strategic petroleum reserves since 2022 following the struggle between Russia and Ukraine. The struggle led to extend within the value of gasoline merchandise. The US authorities’s transfer to attract crude oil from reserves was geared toward controlling the gasoline costs within the US then. Market studies additionally famous that the storage within the reserves had reached a 40-year low following this drawdown.

In its Commodities Feed, ING Assume referred to the decline within the crude oil inventories (excluding the strategic oil reserves) within the US for the week ending October 13. It stated that crude oil inventories proceed to edge decrease at a time when they need to be constructing, while shares are additionally a bit of greater than 20 million barrels under the five-year common.

It stated Chinese language macro information launched this week additionally got here in stronger than anticipated. Home demand in China stays strong coming in at round 15.2 million barrels a day, up 3 per cent month on month and 5 per cent larger 12 months on 12 months, it stated.

Market additionally remained cautious following a blast in a hospital in Gaza. There are apprehensions that different neighbouring international locations within the area may intervene within the struggle if the state of affairs escalates. Such developments may result in additional tightness within the crude oil provides within the world market.

October pure gasoline futures had been buying and selling at ₹244.30 on MCX within the preliminary buying and selling hour of Friday morning towards the earlier shut of ₹245.80, down by 0.61 per cent.

On the Nationwide Commodities and Derivatives Change (NCDEX), November castorseed contracts had been buying and selling at ₹6048 within the preliminary buying and selling hour of Friday morning towards the earlier shut of ₹6006, up by 0.70 per cent.

December turmeric (farmer polished) futures had been buying and selling at ₹13450 on NCDEX within the preliminary buying and selling hour of Friday morning towards the earlier shut of ₹13692, down by 1.77 per cent.

[ad_2]