[ad_1]

PSC Insurance coverage has made a $25.2 million bid for Ensurance this morning, with events signing a binding scheme of implementation deed. The deal would see PSC pay a 40% premium on the share value of Ensurance of 26.8 cents per share.

Multinational PSC Insurance coverage Group [ASX:PSI] has introduced that it has entered right into a binding scheme implementation deed to accumulate all the shares of Ensurance [ASX:ENA] for $25.2 million.

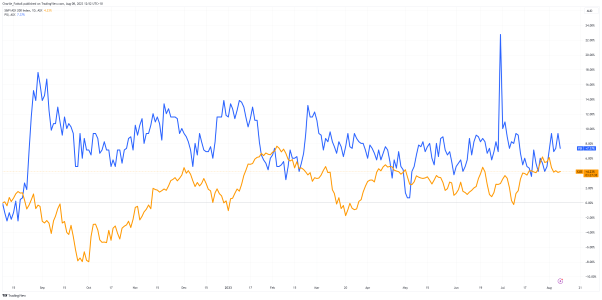

Shares of PSC have been down by 1.22% in the present day whereas Ensurance noticed its shares explode in morning buying and selling, with shares up 33.75%, buying and selling at 26.8 cents per share.

PSC Insurance coverage specialises in turnaround acquisitions inside the insurance coverage sector, with an extended monitor document of reviving companies that function inside Australia, the UK, Hong Kong, and NZ.

It has had a gradual and regular 12 months of development with shares of PSC up by 8.04% previously 12 months.

The one notable shift from its regular buying and selling occurred proper earlier than the tip of the monetary 12 months, which noticed an enormous bounce.

This had some market watchers accusing funds of making an attempt to make the most of the comparatively low liquidity in PSC to boost their period-end performance.

Supply: TradingView

PSC affords $25.2 million for Ensurance

PSC Insurance coverage has issued a bid for Ensurance in the present day. To fund the acquisition, PSC will difficulty 5 million shares to ENA shareholders and pay any distinction in worth to the $25.2 million remaining in money.

The acquisition value represents an implied valuation of Ensurance of $18 million plus $7 million in property, largely represented in money held by the corporate.

The valuation represents a 40% premium to ENA’s closing value on Monday of 20 cents a share.

Ensurance operates an Australian-based underwriting enterprise specialising in development and terrorism & sabotage underwriting throughout Australia and the UK.

PSC mentioned the acquisition will add a high-growth operation and new product suite to PSC’s Australian Specialty companies led by PSC’s Adam Burgess.

PSC expects an annualised EBITDA of over $1.5 million within the first 12 months of the acquisition, with stronger development expectations sooner or later.

The implementation deed consists of the same old exclusivity phrases, which embody the ‘no store, no speak’ restrictions and matching rights for PSC in relation to any competing proposals.

The acquisition must be accomplished with out an excessive amount of drama from both aspect. Nevertheless, it might not be the primary time this 12 months that PSC has pulled out of discussions.

Again in Could, a deliberate three way partnership between PSC and AUB Group [ASX:AUB] was scrapped unexpectedly by PSC with out rationalization.

On the time, PSC merely acknowledged that:

‘The group has a strong pipeline of acquisitions, and our steadiness sheet is in a robust place to proceed to develop this with our selective and disciplined M&A (mergers and acquisitions) technique.’

The ENA board has unanimously beneficial that shareholders approve the scheme within the absence of a greater deal. With firm administrators holding vital chunks of voting shares, it seems a forgone conclusion.

Outlook for PSC Insurance coverage

This acquisition is a sound strategic transfer for PSC Insurance coverage because it expands its footprint into development and monetary safety for essential infrastructure.

ENA is a well-respected enterprise with a robust monitor document of development. Its somewhat specialised phase of insurance coverage will broaden PSC past its current development underwriting firms reminiscent of Chase Underwriting.

Some market indicators may spell bother on the waters for development insurance coverage as value will increase, dangerous climate, and labour shortages have slowed the nation’s development.

The full business’s pipeline of labor sits at a document $224 billion.

Construction insolvencies have surged to 2213 to this point this 12 months, the best within the final decade.

Whether or not this makes a fabric distinction to ENA stays to be seen — for now, the deal appears promising.

The acquisition is accretive to earnings from the outset, which ought to make it an awesome alternative for PSC Insurance coverage to develop its enterprise and create shareholder worth.

PSC expects an EBITDA of roughly $111 million for FY2023 and has issued steering of $122–127 million for FY24.

I count on that the acquisition of ENA shall be a constructive improvement for PSC Insurance coverage and can create a robust participant within the development, plant and gear insurance coverage industries.

Final day for a giant window of alternative

Earlier than you go, I wished to indicate you a latest presentation by our veteran dealer, Murray Dawes.

Murray has the expertise and persistence to know when to pursue nice trades.

He has had a 33% common portfolio return since 2018 and is thought for ready for the proper time to maneuver.

And he’s noticed a chance to select up bargains he thinks don’t come round too typically.

He’s dubbed it ‘Window 24’ and in the present day is the final day to affix.

Murray isn’t a quick and free dealer however a meticulous reader of charts and supervisor of danger.

So, when he thinks there are shopping for alternatives, it’s worthwhile to pay attention.

You may take a look at Murray’s ‘Window 24’ presentation here.

Regards,

Charles Ormond,

For The Every day Reckoning Australia

[ad_2]

![PSC Insurance coverage [ASX:PSI] Makes Bid for Ensurance [ASX:ENA]](https://triangleprofits.com/wp-content/uploads/2023/10/ASX-ENA-FEATURE-TICKER-750x375.png)