[ad_1]

Try MintBroker Worldwide Ltd’s SEC filings on EDGAR. There was nothing filed previous to June twenty ninth, 2018. The one SEC types filed up to now are forms 3 and 4.

The SEC describes the usage of these types (emphasis mine):

Company insiders – that means an organization’s officers and administrators, and any helpful homeowners of greater than ten p.c of a category of the corporate’s fairness securities registered beneath Part 12 of the Securities Alternate Act of 1934 – should file with the SEC a press release of possession relating to these securities.

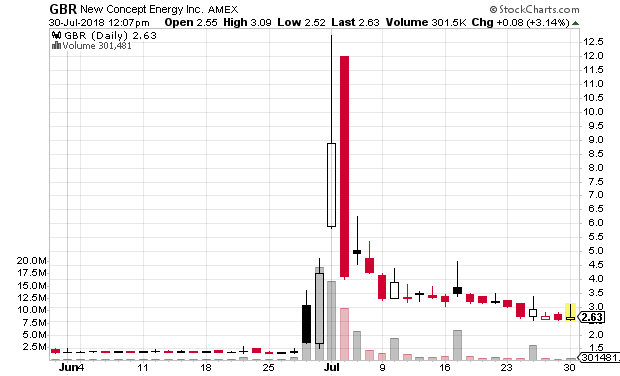

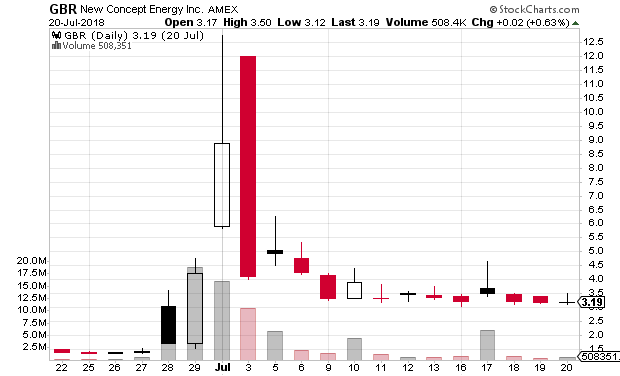

New Idea Power (GBR)

First I need to take a look at New Idea Power (GBR). As of its most up-to-date SEC Form 10-Q/A, GBR confirmed 2,131,935 shares excellent as of Could 11, 2018.

Here’s a extra zoomed-in view exhibiting every date:

The inventory first spiked on June twenty eighth, gapping up large on no obvious information (a form SC-13D had been filed after the day prior to this’s shut by Realty Advisors, Inc however that disclosed no new data — all the information in it was accessible within the June 21st, 2018 8-k filed by GBR). The inventory then closed at $1.7201, properly beneath the open worth of $3.02. On July twenty ninth GBR gapped down a tiny bit to $1.69 earlier than spiking large and shutting at $4.22. At 6:39 pm (all occasions Japanese) MintBroker filed an SEC Form 3 exhibiting direct possession of 1,073,713 shares with the “date of occasion requiring assertion” being 06/29/2018.

The next buying and selling day, July 2nd, GBR opened at $5.90 and hit a excessive of $12.75 earlier than closing at $8.90. On July third the inventory gapped up once more, opening at $12.00 after which dropping to shut at $4.11. A form 4 filed by MintBroker at 11:14am on July third revealed that the corporate had bought 114,576 shares on July 2nd at a median worth of $11.32 and nonetheless owned 959,137 shares.

The next day the market was closed for the July 4th Independence Day vacation. On July fifth, GBR gapped up, opening at $5.03 and shutting at $4.95. At 11:51am on July fifth MintBroker filed another form 4 exhibiting that it had bought 959,137 shares on July third at a median worth of $8.682 and now not owned any shares.

It’s straightforward to guess at MintBroker’s earnings with this data. I added up the overall gross sales of inventory to get $9,624,227.75 ($8.9635 per share). If we assume it paid a median of $4.22 (the shut on July twenty ninth), which is nearly definitely greater than the value it really paid, then it paid $4,531,068.86 for these shares and profited $5,093,159. After all there’s plenty of data I don’t have so that is simply an informed guess.

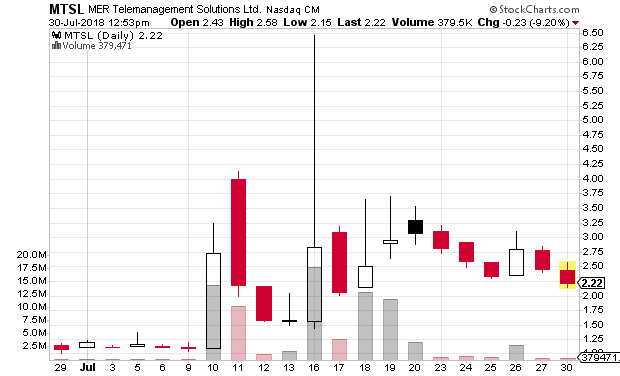

MER Telemanagement Options ltd (MTSL)

As of it most up-to-date Form 20-F from December 31, 2017, MER Telemanagement Options (MTSL) reported 3,120,684 shares excellent. Beneath is the each day candlestick chart of MTSL:

On July tenth, 2018 MTSL spiked from an open of $1.10 to shut at $2.73. The following day it gapped as much as $4.00 and closed at $2.19. The next day, July twelfth at 1:56pm, MintBroker filed a form 4 exhibiting that it had acquired 147,716 shares at a median worth of $4.6189 on 7/11/2018 and had bought 446,911 shares at a median worth of $3.603 on the identical day. MintBroker has not filed every other SEC types on MTSL.

Clearly the variety of shares on that kind 4 don’t match and it wasn’t a kind 3 indicating that it wasn’t the primary acquisition of MTSL shares by MintBroker. My opinion provided that data is that MintBroker possible purchased the opposite 299,195 shares on July tenth. Assuming that these shares have been bought at a median of $2.73 (the closing worth on July tenth), the common buy worth of the overall 446,911 shares can be $3.3543. That provides me an estimate of ‘solely’ $111,146 in earnings.

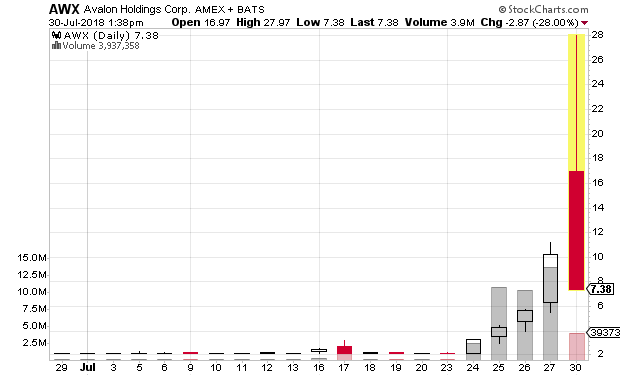

Avalon Holdings (AWX)

Avalon Holdings is the latest inventory for which MintBroker has filed a Type 3 or Type 4. As of Could 4th (per the corporate’s May 10th Form 10-Q) Avalon Holdings reported 3,191,100 shares excellent. Beneath is the each day candlestick chart of AWX:

Beginning on July twenty fourth, AWX began spiking on no information. It traded thrice the shares excellent on every of the next two days. On July twenty seventh, 2018 at 5:47pm MintBroker filed an SEC Form 3 exhibiting direct possession of 1,922,095 shares with the “date of occasion requiring assertion” being 7/27/2018.

In premarket buying and selling AWX hit a excessive of $36.00 however since 8:30am has dropped so much and as I write this the inventory is at $7.80. I eagerly await a future MintBroker Type 4 on AWX.

Closing Outcomes: AWX

This part was added on August 2nd after MintBroker filed the anticipated Types 4 exhibiting that they bought all of their shares. Following are the dates/particulars of the Types 4.

7/30/2018 4:58pm Form 4 — 192,340 shares bought at $15.5054 (incorrectly confirmed “A” in field 4 which might imply ‘acquired’).

7/31/2018 1:34pm Form 4 — 719,885 shares bought at a median worth of $8.175

8/1/2018 11:19am Form 4 — 799,720 shares bought at common worth of $4.1506

8/1/2018 11:42am Form 4 — 202,642 shares bought at common worth of $3.911 (zero shares held after this)

8/1/2018 1:41pm Form 4/A — correcting 7/30 kind 4 to indicate 192,340 shares bought at $15.504 on 7/27

This provides as much as a median sale worth of $6.779 on 1,914,587 shares. Observe that this doesn’t fairly add as much as the variety of shares proven within the kind 3 (1,922,095) — in reality it’s 7,508 shares much less. However that’s not essential in comparison with the overall variety of shares traded by MintBroker so I’ll ignore the distinction.

If I have been to make use of the identical very conservative estimate I used on GBR and MTSL to guess the acquisition worth of all these AWX shares I might use the closing worth on 7/27, which was $10.25. This could have resulted in a MintBroker lack of $6.65 million {dollars}. Nevertheless, a lot of the spike on AWX on 7/27 got here on the finish of the day and for a lot of the day it traded beneath $7.00. The truth is, as of the shut on 7/27 the volume-weighted common worth (VWAP) of AWX was solely $7.282 (see intraday chart with VWAP). If that’s the worth that MintBroker paid then it solely misplaced $963,037 on the commerce. Clearly if Mintbroker purchased beneath the vwap or had acquired some portion of the shares on a previous day at a cheaper price it’s nonetheless doable that they made cash on the commerce — there isn’t any means for us to know simply by taking a look at their filings.

Who/What’s MintBroker?

MintBroker Worldwide, Ltd has its tackle listed as

ELIZABETH AVE. & BAY STREET

NASSAU C5 N-8340

in its SEC filings. This is similar tackle given by Suretrader for “Swiss America Securities Ltd” the corporate that runs it. It seems that MintBroker Worldwide Ltd is the successor to Swiss America Securities or the dad or mum firm of it as a result of the Suretrader web site exhibits the copyright as “Copyright 2008 – 2018 MintBroker Worldwide, Ltd”

To take away any doubt, MintBroker is owned by Man Gentile, as he describes in his recent lawsuit, Mint Financial institution Worldwide, LLC and Man Gentile Nigro v. Workplace of the Commissioner of Monetary Establishments of

Puerto Rico et al. ((3:18-cv-01441) US District Court docket, District of Puerto Rico) (See docket on CourtListener.com).

21. Gentile is the present helpful proprietor of a bunch of monetary establishments positioned in the USA and different international nations (“Group”). The Group consists of MintBroker Worldwide, Restricted within the Bahamas and its wholly-owned subsidiaries, MintBroker Worldwide Restricted in U.Ok. The Group is concerned in numerous areas of the monetary markets together with, however not restricted to, holding accounts of clearing corporations and sustaining custody of funds.

22. The SureTrader division of MintBroker has loved important success.

Apart from being recognized for proudly owning Suretrader, Man Gentile was additionally the topic of a fascinating article in Bloomberg in early 2017, “‘Bro, I’m Going Rogue’: The Wall Street Informant Who Double-Crossed the FBI.”

[Edit 8/2/2018]: Bloomberg had a nice story on the run-up in Avalon Holding Coporation (AWX) shares wherein they talked to the CEO of Avalon and to Man Gentile. Right now Matt Levine of Bloomberg analyzed the situation:

His brokerage agency introduced stakes in three tiny corporations, together with $13 million waste-management agency Avalon Holdings Corp., whose costs all “skyrocketed after which dropped.” The enjoyable half is Gentile’s clarification:

“That is no pump-and-dump scheme,” Gentile, chief govt officer of MintBroker, stated over the telephone. “We have been going to attempt to do a hostile takeover of the corporate.”

Ah. However right here’s what Avalon said:

In response to inquiries relating to a possible change in management, Mr. Ronald Klingle, Chairman and Chief Government Officer of the Firm, holds roughly 67% of the voting energy in Avalon, and has suggested the Firm that he has no current plans to divest any of his holdings.

What … occurred right here? Did Gentile not know that the corporate’s inventory was managed by its CEO? (It’s easy to find out!) Did he know that however suppose that he might do a hostile takeover anyway? (By, like, calling up the CEO and being actual hostile on the telephone till he agreed to promote?) Was it a pump-and-dump scheme, however Gentile was too lazy to make up a believable cowl story?

Observe: Timestamps on SEC filings come from Purchase Media NewsEdge V8. Screenshot.

Disclaimer: I’m quick 30 shares of AWX and I’ll shut that place or improve it and even go lengthy at any time. I’ve no place in every other inventory talked about above. I’ve no relationship with any events talked about above besides that one of many buying and selling platforms I exploit is DAS Dealer Professional and it might share frequent possession with MintBroker (I’m not positive). This weblog has a terms of use that’s included by reference into this put up; you’ll find all my disclaimers and disclosures there as properly.

[ad_2]