[ad_1]

- The greenback fell amid a rush into the yen.

- The pound depreciated by practically 1% towards the greenback final week.

- The Financial institution of England will convene subsequent week for discussions on financial coverage.

At the moment’s GBP/USD outlook is bullish. On Monday, the pound strengthened, capitalizing on a major decline within the greenback towards the Japanese yen.

-Are you searching for automated trading? Test our detailed guide-

Notably, Financial institution of Japan Governor Kazuo Ueda’s weekend assertion urged that the central financial institution would possibly discontinue its detrimental rate of interest coverage when it will get nearer to reaching its 2% inflation goal.

Consequently, the greenback confronted the brunt of the push into the yen, experiencing its most substantial drop towards the Japanese forex in two months. In the meantime, the pound depreciated practically 1% towards the greenback final week. A mixture of strong financial knowledge and waning investor confidence elevated demand for the US forex.

Elsewhere, the Financial institution of England will convene subsequent week to debate financial coverage. At the moment, merchants assign a 70% chance of a quarter-point improve within the Financial institution Fee to five.50%. Nonetheless, the prospects of further price hikes have been considerably decreased. This marks a stark reversal from only a week in the past when cash markets projected that UK charges may peak nearer to five.7% by March.

One cause for the pound’s energy this yr has been the notion that the Financial institution of England must take extra motion to curb inflation. Consequently, buyers anticipated extra rate of interest hikes in comparison with different central banks.

Nonetheless, with market members seeing the tip of this cycle in sight, the pound might face challenges in gaining important upward momentum within the coming weeks.

GBP/USD key occasions in the present day

Traders don’t anticipate important developments from the UK or the US in the present day, so the value will possible lengthen the yen transfer.

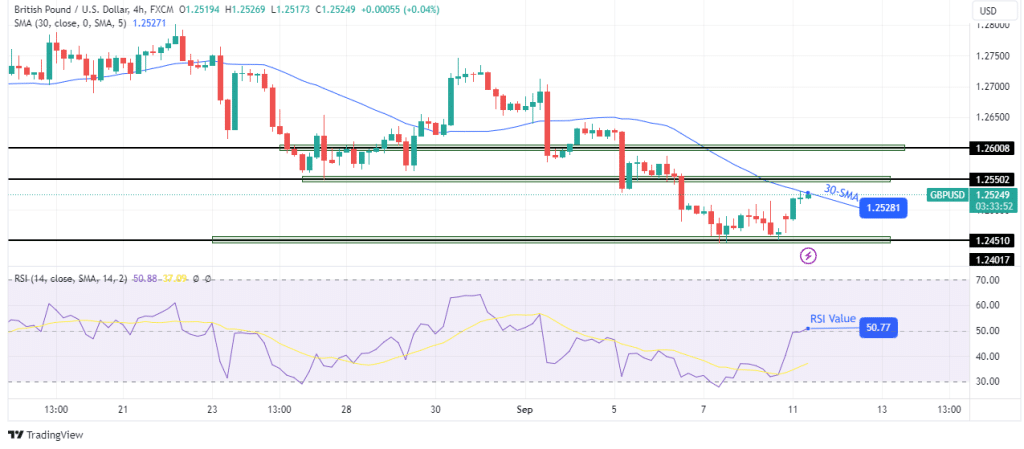

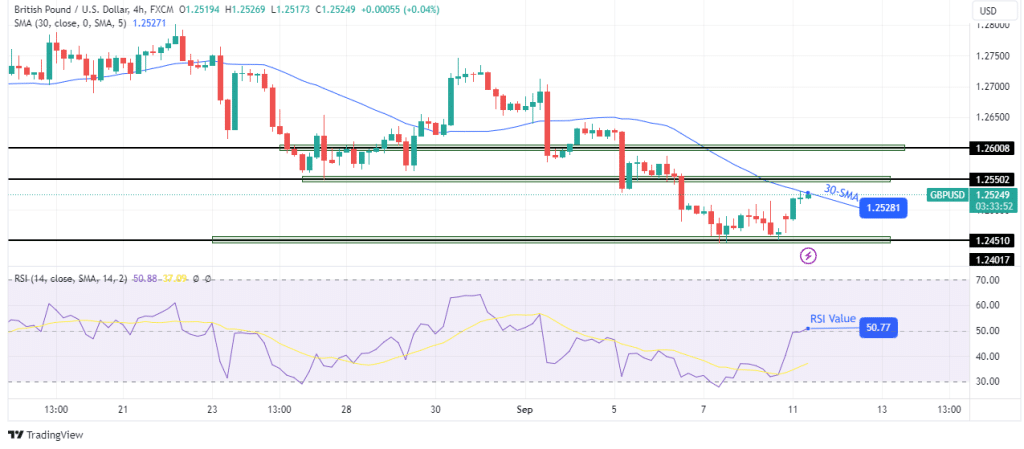

GBP/USD technical outlook: Bulls problem bias with RSI crossing 50.

On the charts, the GBP/USD pair has rebounded from the 1.2451 help degree and is at present difficult the 30-SMA resistance. Nonetheless, the overall path of the value is down because the decrease lows and highs sample nonetheless holds.

-If you’re fascinated by forex day trading then have a learn of our information to getting started-

Nonetheless, bulls are difficult the bullish bias because the RSI has crossed above 50. The value now solely must cross above the 30-SMA and the 1.2550 resistance degree for bulls to take over. Nonetheless, if these resistance ranges maintain, the value will possible fall again to the 1.2451 help.

Trying to commerce foreign exchange now? Make investments at eToro!

67% of retail investor accounts lose cash when buying and selling CFDs with this supplier. You need to take into account whether or not you possibly can afford to take the excessive danger of dropping your cash.

[ad_2]