By Julie Fernandez, Senior Financial Analyst at Triangle Profits

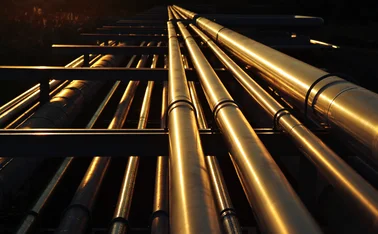

Introduction: A Volatile Year for Crude Oil

2024 has been a rollercoaster year for crude oil, with prices swinging between extreme highs and lows. As global markets grapple with economic uncertainty, energy traders are finding themselves in uncharted waters. This article dives into the factors driving crude oil prices this year and what traders should watch for in the months ahead.

Key Drivers of Crude Oil Prices

- Geopolitical Tensions: With ongoing conflicts in the Middle East and heightened tensions between major oil producers, crude oil prices have seen significant spikes. Traders must stay informed about geopolitical developments, as these can trigger rapid price movements.

- Supply Chain Disruptions: The ripple effects of the COVID-19 pandemic are still felt in global supply chains. Reduced production capacity, combined with labor shortages, has led to supply bottlenecks that continue to impact oil prices.

- Environmental Policies: As more countries commit to carbon neutrality, the oil industry faces new regulations and taxes. These policies are likely to reduce global demand for oil in the long term, leading to market uncertainty.

Market Outlook: What to Expect?

As we move further into 2024, analysts predict that crude oil prices will remain volatile. Factors such as OPEC’s production decisions, the strength of the US dollar, and the pace of economic recovery in major economies will play crucial roles.

Short-Term Predictions: Expect prices to hover between $70-$90 per barrel as markets digest new economic data.

Long-Term Trends: The shift towards renewable energy will inevitably put downward pressure on oil prices, although this transition may take years to fully materialize.

Investment Strategies in a Volatile Market

For traders looking to capitalize on the volatility, diversification remains key. Consider balancing your portfolio with a mix of oil futures, energy stocks, and renewable energy investments. Hedging against potential losses through options or other derivative instruments can also mitigate risks.

Conclusion: Staying Ahead in Uncertain Times

Crude oil remains a crucial commodity in global markets, but 2024 has proven that predicting its price is more challenging than ever. By staying informed about geopolitical events, environmental regulations, and market trends, traders can navigate this volatile landscape with greater confidence.